Vietnam has emerged as a compelling alternative for buyers implementing "China+1" sourcing strategies. With US$8-10 billion in bag exports and favorable trade agreements with the EU and CPTPP countries, Vietnam offers real advantages for certain buyer profiles. This guide covers what Western buyers need to know about sourcing beach bags from Vietnam—including the honest limitations.

Quick Assessment

Best for: Buyers selling to EU/CPTPP markets seeking tariff advantages

Consider carefully if: You need specialized beach bag expertise or complex natural material sourcing

Key advantage: Trade agreements (EVFTA, CPTPP) provide duty-free or reduced tariff access to major markets

Why Buyers Are Looking at Vietnam

Several factors are driving interest in Vietnam for bag manufacturing:

- Tariff advantages: EU-Vietnam Free Trade Agreement (EVFTA) provides duty-free access for qualifying products

- CPTPP membership: Favorable treatment in 11 member countries including Japan, Canada, Australia

- Labor costs: 30-40% lower than China's coastal manufacturing hubs

- Supply chain diversification: Risk mitigation against China-specific trade tensions

- Growing capability: Vietnam's bag industry has developed significantly over the past decade

Important Context

Vietnam's bag manufacturing industry is primarily focused on backpacks, travel bags, and technical products. Beach bag-specific expertise is less developed than in China, particularly for natural materials like straw and raffia.

Vietnam's Bag Manufacturing Industry

Vietnam has established itself as a global Top 3 bag manufacturing destination, alongside China and Bangladesh. The industry has grown substantially over the past decade, driven by foreign investment and trade agreement benefits.

$8-10B

Annual bag exports (2024)

Top 3

Global ranking for bag production

30-40%

Labor cost savings vs. China coastal

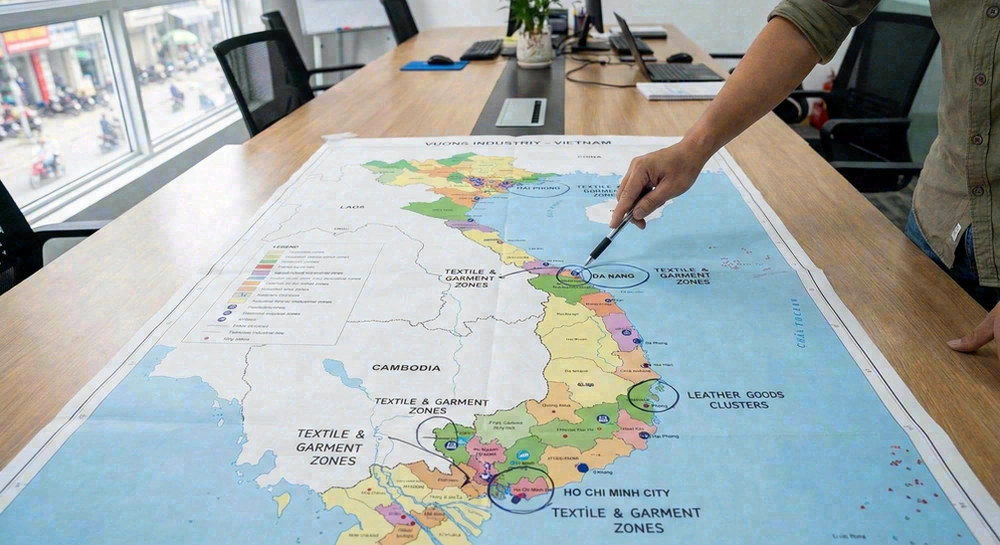

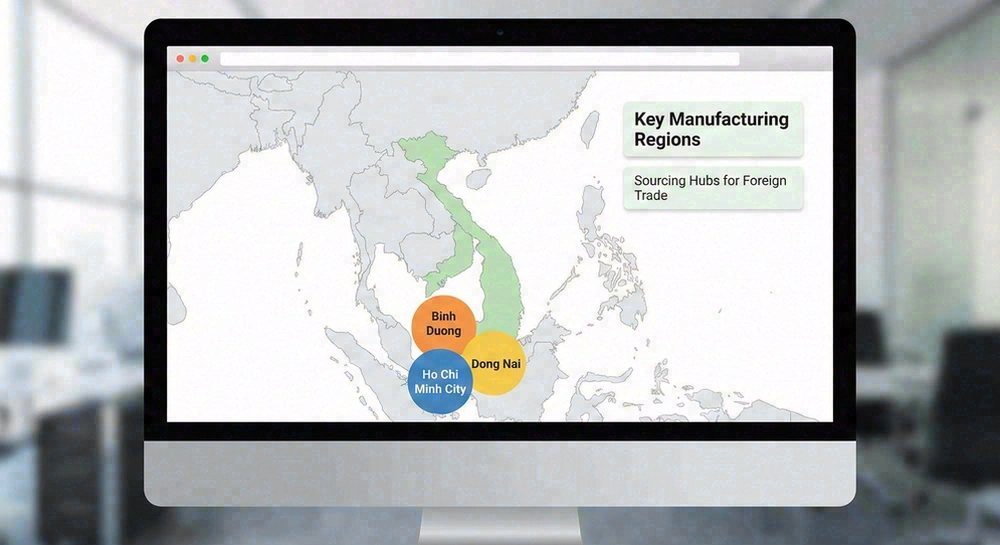

Key Manufacturing Regions

| Region | Characteristics | Best For |

|---|---|---|

| Ho Chi Minh City | Most established hub, best infrastructure, largest supplier network | Quality-focused orders, complex products |

| Binh Duong Province | Industrial parks, growing capacity, lower costs than HCMC | High-volume production, cost optimization |

| Dong Nai Province | Modern facilities, port access, industrial zones | Export-focused manufacturing |

Top Bag Manufacturers in Vietnam

The following manufacturers offer bag production capabilities relevant to beach bag buyers. Note that most Vietnamese manufacturers specialize in backpacks and technical bags rather than beach-specific products.

1. Ligoco Vietnam

Established: 2018

Location: Vietnam

Capacity: 100,000 pieces/month

Specialization: Tote bags, canvas bags, jute bags

Beach Bag Relevance: HIGH - Directly produces tote bags, canvas bags, and jute bags—all relevant to beach bag category. Also makes non-woven bags and backpacks.

Best fit for canvas and natural fiber beach bags

2. Hop Phat Bag & Backpack Garment Co.

Established: 20+ years

Location: Ho Chi Minh City

Capacity: 30,000-200,000 units/month

Markets: USA, Japan, Italy, South Korea, Malaysia (15+ countries)

Beach Bag Relevance: MEDIUM - Focuses on eco-friendly laptop and school bags, but large capacity and export experience make them adaptable for beach tote production.

Consider for large-volume eco-friendly bag production

3. Vibama

Established: 2013

Location: Ho Chi Minh City

Capacity: 80,000-100,000 units/month

Facility: 5,000+ sqm

Beach Bag Relevance: MEDIUM - Specializes in tactical backpacks, duffle bags, and travel bags. Duffle bag capability transfers well to large beach totes.

Consider for duffle-style beach bags and large totes

4. Mikkor Vietnam

Established: 12+ years

Location: Ho Chi Minh City & Dong Nai Province

Capacity: 1,000+ pieces daily

Website: mikkorvietnam.com

Beach Bag Relevance: MEDIUM - Modern facilities and good capacity for complex bags. Experience with multiple bag types.

Good for quality-focused production

5. KimTa Bags

Location: Ho Chi Minh City

Website: kimtabags.com

Services: OEM/ODM manufacturing

Products: Bags, backpacks, accessories

Beach Bag Relevance: MEDIUM - Contract manufacturing with OEM capabilities. Can adapt to beach bag requirements.

Good for custom OEM projects

6. DoMinGo Bag Factory

Established: 2014

Location: District 12, Ho Chi Minh City

Markets: Japan, South Korea, Australia, Netherlands, Sweden, USA, Canada, Singapore

Website: domingobag.com

Beach Bag Relevance: MEDIUM - Strong export track record to quality-conscious markets. General bag manufacturing adaptable to beach products.

Good for export-focused projects

7. ASG Vietnam

Location: Binh Duong & Long An Province

Facilities: Two manufacturing plants

Partnerships: High Sierra, Bakley

Markets: USA, Europe, Asia

Beach Bag Relevance: MEDIUM - Major OEM manufacturer with brand partnerships. Experience with Western brand requirements and quality standards.

Consider for branded partnerships

Advantages of Sourcing from Vietnam

Trade Agreement Benefits

- EVFTA: Duty-free access to EU markets for qualifying products

- CPTPP: Favorable tariffs in 11 countries including Japan, Canada, Australia

- GSP status: Generalized System of Preferences benefits

Cost Advantages

- Labor costs: 30-40% lower than China's coastal cities

- Competitive pricing: Especially for labor-intensive products

- Growing efficiency: Infrastructure and skills improving

Risk Diversification

- China+1 strategy: Reduces single-country dependency

- Trade tension protection: Hedges against China-specific tariffs

- Political stability: Reliable business environment

Quality Capability

- Certification: Many factories hold BSCI, WRAP, ISO 9001

- Export experience: Strong track record with Western brands

- Young workforce: Trainable and motivated

Challenges to Consider

Limited Beach Bag Specialization

Vietnam's bag industry focuses primarily on backpacks and technical bags. Beach bag expertise—especially for natural materials like straw and raffia—is less developed than in China.

Material Sourcing

Many materials still imported from China. For natural fibers (seagrass, raffia, straw), China's Shandong province has more established supply chains.

Smaller Scale

Manufacturing capacity is smaller than China. Very large orders may strain supplier capabilities or require splitting across factories.

Communication

English proficiency varies. Working with sourcing agents can help bridge communication gaps.

Quality Consistency

Varies more between suppliers than in mature China manufacturing clusters. Due diligence and factory visits are important.

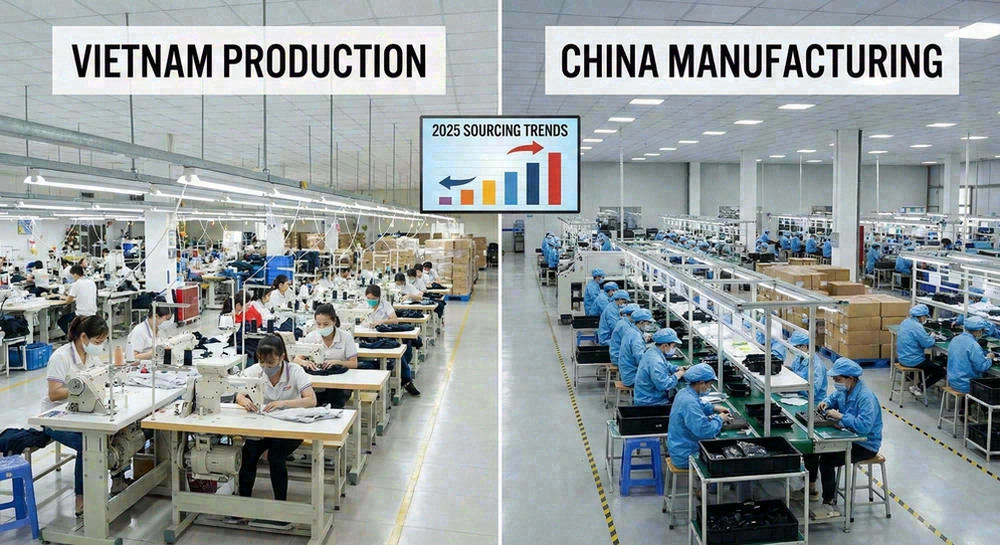

Vietnam vs. China: Beach Bag Manufacturing

| Factor | Vietnam | China |

|---|---|---|

| Labor Cost | Lower | Higher (coastal) |

| Manufacturing Scale | Smaller | Massive |

| Beach Bag Expertise | Developing | Established (decades) |

| Natural Material Supply | Limited | Excellent |

| EU Tariff Access | Duty-free (EVFTA) | Standard duties |

| US Tariff Situation | Standard rates | Section 301 tariffs |

| Lead Time | Similar | Similar |

| Quality Consistency | Varies | More consistent |

Bottom Line

Vietnam offers real advantages for buyers selling to EU/CPTPP markets or implementing diversification strategies. For beach bags specifically—especially straw, raffia, and complex natural material products—China's established supply chains and decades of expertise often provide better quality, consistency, and pricing.

How to Source from Vietnam

- Use sourcing agents: Local agents familiar with Vietnam's manufacturing landscape can help identify suitable suppliers, negotiate terms, and handle communication.

- Visit factories: In-person visits remain the best way to assess capability and quality systems. Many buyers combine Vietnam trips with sourcing trade shows.

- Request multiple samples: Quality can vary. Test samples thoroughly before committing to bulk orders.

- Verify certifications: Request and verify compliance certificates (BSCI, ISO, etc.) directly with certifying bodies.

- Plan for material lead times: If materials are imported from China, factor this into your timeline.

- Build relationships: Long-term partnerships help ensure consistent quality and priority treatment.

Frequently Asked Questions

Labor costs are 30-40% lower in Vietnam. However, total landed cost depends on material sourcing (often from China), shipping routes, and tariff situations. For EU/CPTPP markets, Vietnam's trade agreements can make it significantly cheaper. For US buyers, the calculation is more complex.

Similar to China: 500-1,000 units for custom orders at most manufacturers. Some may accept 300 units for stock designs or repeat orders. Very small orders (under 300) are typically handled through trading companies at higher per-unit cost.

Vietnam's bag industry focuses primarily on backpacks and technical bags. Canvas totes and simple beach bags are well within capability, but specialized beach bag products (straw, raffia, complex natural materials) are less developed than in China.

EVFTA provides duty-free access to EU markets. CPTPP covers 11 countries including Japan, Canada, Australia, Mexico, and Singapore with reduced or eliminated tariffs. These agreements can significantly reduce landed costs for qualifying products.

Quality varies more between suppliers in Vietnam than in China's mature manufacturing clusters. Top Vietnamese factories produce excellent quality, but due diligence is more important. Factory visits and sample testing are essential.

Consider China for Beach Bag Expertise

While Vietnam offers compelling advantages for certain buyer profiles, China remains the global leader for beach bag manufacturing—particularly for natural materials and complex designs.

Clanbag: 24 Years of Beach Bag Manufacturing

If you're also considering China sourcing—or need specialized beach bag expertise that's hard to find in Vietnam—Clanbag offers dedicated beach bag manufacturing with decades of experience.

- + Specialized in beach bags (canvas, straw, raffia, mesh, waterproof)

- + Established supply chains for natural materials

- + Full customization and OEM/ODM capabilities

- + MOQ from 500 units

Conclusion

Vietnam is a legitimate option for beach bag sourcing, particularly for buyers selling to EU/CPTPP markets or implementing supply chain diversification. The country offers lower labor costs, favorable trade agreements, and growing manufacturing capability.

However, for beach bags specifically—especially natural material products like straw and raffia—Vietnam's industry is still developing the specialized expertise that China has built over decades. Evaluate your specific needs carefully:

- Choose Vietnam if: You sell primarily to EU/CPTPP markets, need basic canvas/tote beach bags, or are implementing a diversification strategy

- Consider China if: You need natural material expertise (straw, raffia, seagrass), require large-scale production, or prioritize quality consistency

Many buyers find value in a dual-sourcing approach—using Vietnam for certain products while maintaining China relationships for specialized items.